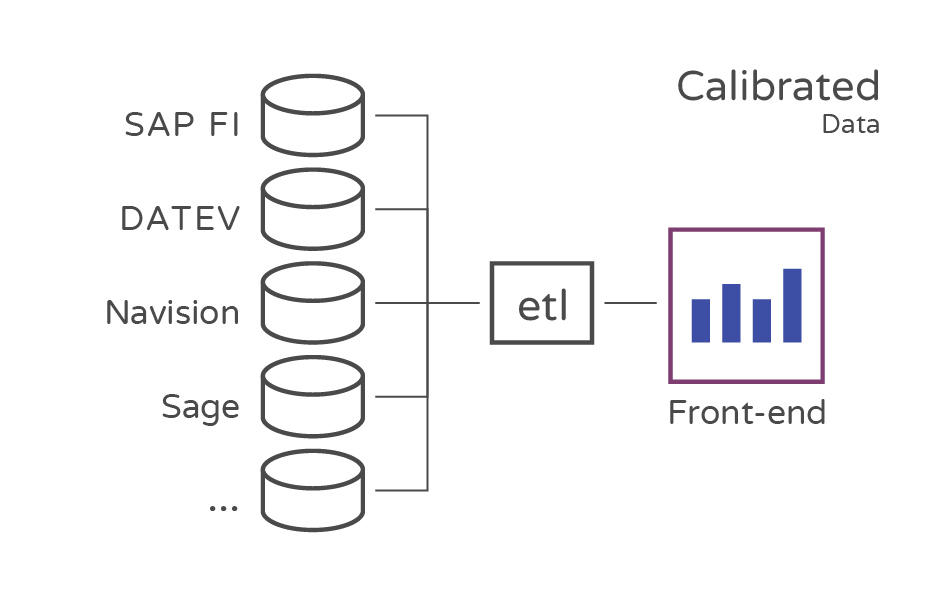

We consolidate your company’s financial data from 75 different ERP systems into a single interface.

Always working with the same data structure is an undisputed advantage. Data is delivered in the same format – every single time – with our standard output interface. If you have more than 1 ERP in use, such as SAP and Oracle, that’s no problem. You’ll receive the data via the same structure. Easydash therefore guarantees sustainable reporting.